dallas texas sales tax rate 2020

The sales tax rate in Dallas Texas is 825. The December 2020 total local sales tax rate was also 8250.

Tax Rates City Of Richardson Economic Development Department

2020-2021 MO and IS Tax Rates.

. Dallas College DCCCD 0096038. The current total local sales tax rate in Dallas County TX is 6250. Texas has a 625 sales tax and dallas county collects an additional na so the minimum sales tax rate in.

Ad Find Out Sales Tax Rates For Free. Tax Rates Downtown Administration Records Building 500 Elm Street Suite 3300 Dallas TX 75202 Telephone. The minimum combined 2022 sales tax rate for Dallas Texas is.

2020 rates included for use while preparing your income tax deduction. This is the total of state county and city sales tax rates. While many other states allow counties and other localities to collect.

The total sales tax rate in any given location can be broken down into state county city and special district rates. 625 percent of sales price minus any trade-in allowance. The December 2020 total local sales tax rate was also 6250.

El Paso TX Sales Tax Rate. 214 653-7888 Se Habla Español 2022 Tax Rates. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805.

Dallas TX Sales Tax Rate. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. The 2018 United States Supreme Court decision in South Dakota v.

Denton TX Sales Tax Rate. Frisco TX Sales Tax Rate. 2016-2017 MO and IS Tax Rates.

The current total local sales tax rate in Lake Dallas TX is 8250. There is no applicable county. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax.

Fort Worth TX Sales Tax Rate. The Texas sales tax rate is currently. This is the total of state county and city sales tax rates.

Texas has a 625 sales tax and Dallas County collects an additional. 2018-2019 MO and IS Tax Rates. The County sales tax rate is.

Local taxing jurisdictions cities counties special. The Texas state sales tax rate is currently. The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Dallas local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special.

Records Building 500 Elm Street Suite 3300 Dallas TX 75202. The County sales tax. The Texas sales tax rate is currently.

Groceries prescription drugs and non-prescription drugs are exempt from the Texas. Fast Easy Tax Solutions. Fast Easy Tax Solutions.

Download all Texas sales tax rates by zip code. Dallas collects the maximum legal local sales tax. 2019-2020 MO and IS Tax Rates.

214 653-7811 Fax. The Dallas Texas sales tax is 625 the same as the Texas state sales tax. The Dallas County sales tax rate is.

Texas Comptroller of Public Accounts. Ad Find Out Sales Tax Rates For Free. The minimum combined 2022 sales tax rate for Lake Dallas Texas is.

2017-2018 MO and IS Tax Rates.

2022 2023 Tax Information Euless Tx

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Texas Property Tax Rates Cantrell Mcculloch Inc Property Tax Advisors

Texas Changes Franchise Tax Rules For Retailers And Wholesalers Dallas Business Income Tax Services

Taxes On Sale Of A Home In Texas What To Consider

:watermark(cdn.texastribune.org/media/watermarks/2020.png,-0,30,0)/static.texastribune.org/media/files/e3bd7a15ff52473c07353a752456373e/Dallas%20Skyline%20iStock%20TT.jpg)

Texas Cities Face Budget Shortfalls After Coronavirus The Texas Tribune

Property Tax Postcard Here S What It Means Oak Cliff

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Commercial Real Estate Financing Sales Dallas Texas Northmarq

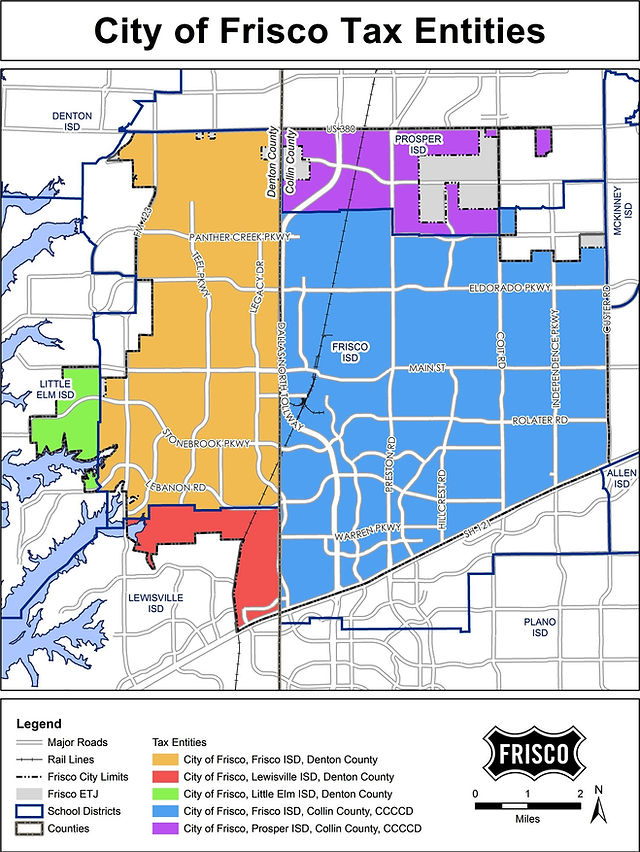

What Is The Property Tax Rate In Frisco Texas

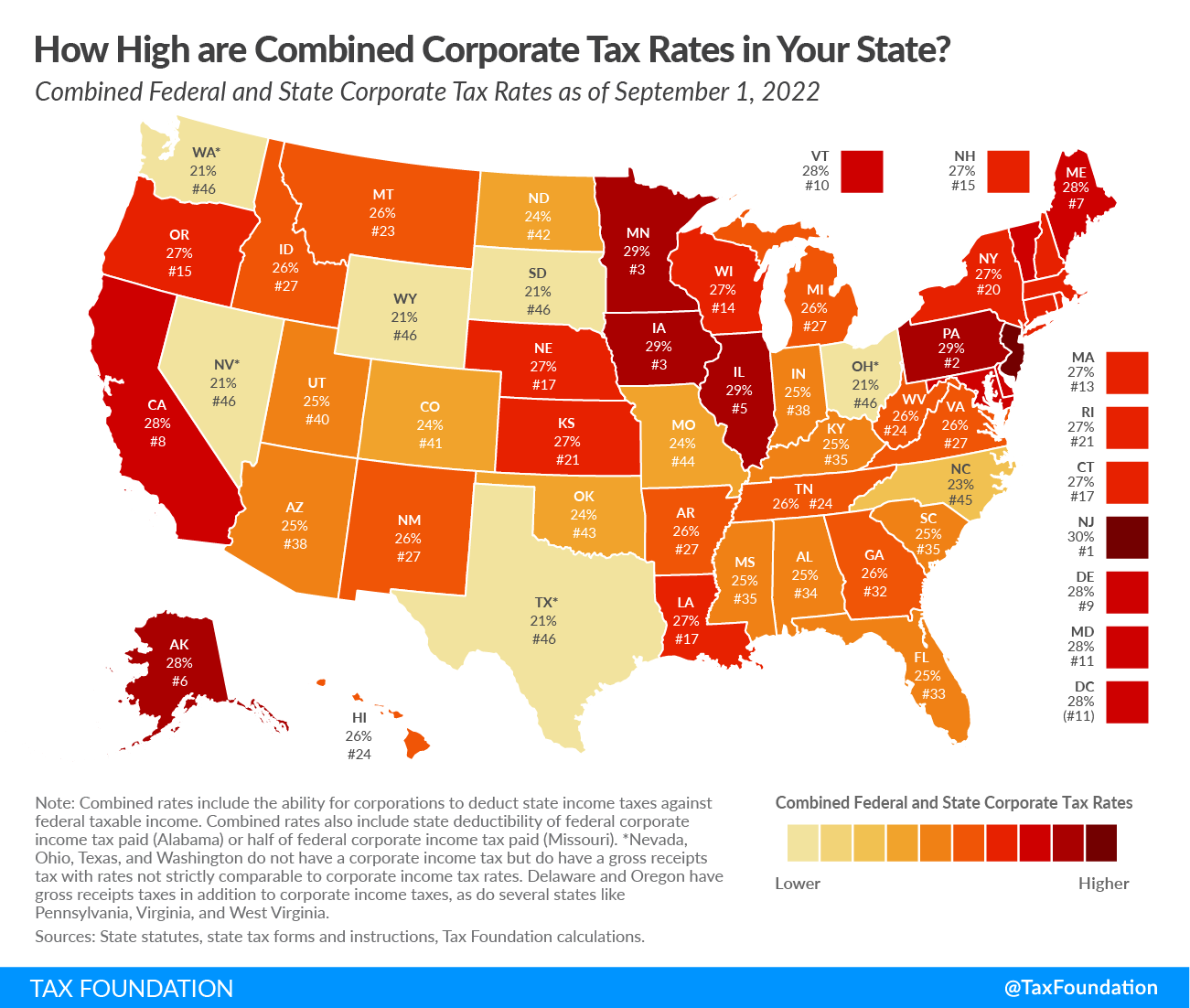

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Texas Sales Tax Guide For Businesses

With No State Income Tax Where Does Texas Get Its Money Curious Texas Investigates

Pandemic Pressures Texas Governments As Property Assessments Rise Bond Buyer

Tennessee 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Dallas Dfw Property Tax Rates H David Ballinger

.png)

Amazon Fba Sales Tax Collection 2021 Usa Everything You Need To Know Just One Dime Blog